Apple’s quarterly earnings report is a testament to the company’s robust performance, as it announced an impressive net income of $25 billion alongside revenues reaching $95 billion for the quarter ending March 29, 2025. This represents a commendable 5 percent year-over-year increase, underscoring the resilience of Apple earnings in a dynamic market. Notably, iPhone sales growth played a pivotal role, contributing nearly 50 percent of total revenues with $46.8 billion, despite witnessing a modest 2 percent rise year-over-year. Additionally, Apple Services growth remains a bright spot, generating $27 billion and showcasing an 11.6 percent increase, now accounting for 28 percent of the company’s overall revenue. As Apple continues to innovate and expand, the potential for Apple revenue 2025 appears promising, reflecting the tech giant’s ongoing strategic ambitions and financial results.

In a recent financial disclosure, Apple showcased its impressive business performance, revealing significant gains in net income and overall revenues for the quarter concluded on March 29, 2025. The tech giant reported a solid increase in its financial metrics, demonstrating the strength of its flagship products and services. The gains from the latest iPhone model, alongside remarkable performance from its services sector, highlight the company’s capacity for growth and profitability. With an increasing share from services and strong demand for hardware, Apple remains a leader in the tech industry, positioning itself for sustained success as it looks toward future revenue growth in the coming years. The latest financial results affirm Apple’s commitment to innovation and market leadership in a competitive landscape.

Apple Quarterly Earnings Report Highlights

Apple’s quarterly earnings report has highlighted the company’s remarkable performance, showcasing a net income of $25 billion with revenues of $95 billion for the quarter ending March 29, 2025. This represents an impressive 5% growth year-over-year (YOY) for both income and revenues. Apple CEO Tim Cook expressed satisfaction with these results, especially noting the robust double-digit growth in Apple Services, which signifies a shift in the company’s revenue structure and a strong focus on services beyond hardware sales.

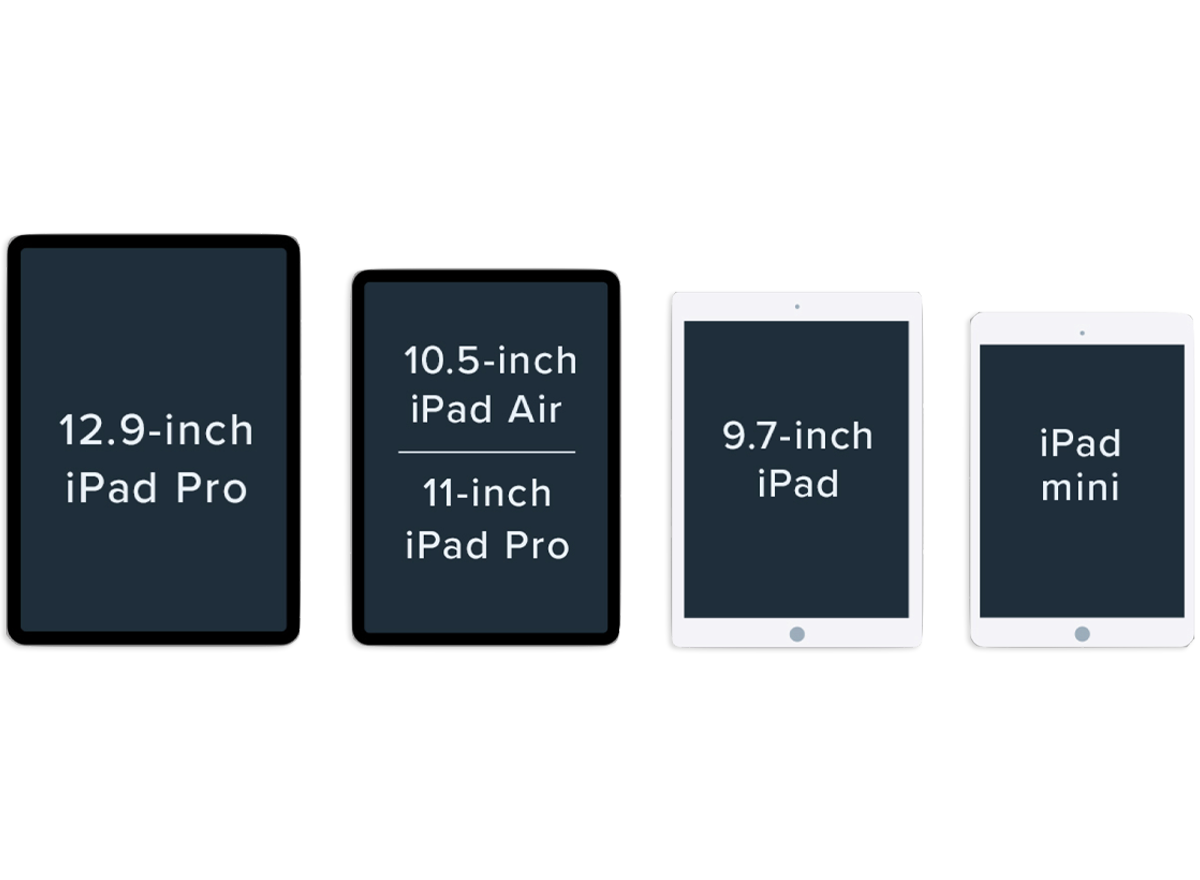

In this earnings report, the iPhone continued to dominate Apple’s revenue streams, generating $46.8 billion—approximately 50% of total revenues. This marks a small increase of about 2% YOY for iPhone sales growth. The strong performance of the iPhone 16e, along with the introduction of new Macs and iPads, suggests that Apple is maintaining a competitive edge in an increasingly saturated market. Additionally, the company demonstrated a commitment to sustainability, successfully reducing carbon emissions by 60% over the last decade.

Exploring Apple’s Revenue Streams and Growth Sectors

Beyond hardware, Apple’s Services segment has been its fastest-growing area, generating $27 billion in revenue this quarter alone, up 11.6% YOY. This growth is indicative of a broader trend where companies are increasingly relying on service-based models. As Apple continues to build its ecosystem, including streaming, App Store purchases, and subscriptions, the contribution of services to Apple’s overall revenue—now making up 28%—is set to increase even further.

The revenue from the Mac and iPad sections also saw noteworthy growth in this quarter, generating $7.9 billion (up 6.7%) and $6.4 billion (up 15%), respectively. This reflects a positive market response to Apple’s innovative offerings, particularly as users increasingly rely on portable and versatile devices for work and entertainment as hybrid work models gain traction. However, the decline seen in Wearables, Home, and Accessories, which dropped 5% to $7.5 billion, suggests there may be challenges in that segment that Apple will need to address moving forward.

As Apple approaches its fiscal goals for 2025, the trajectory of its revenue streams indicates a balanced approach between hardware and services. The successful launch of the iPhone 16e, paired with solid performances in Macs and iPads, places Apple in a strong position to capitalize on future opportunities. Furthermore, Apple’s focus on optimizing its business towards sustainable growth through innovative technology and responsible practices represents a comprehensive strategy that should serve it well in the upcoming years.

Future Projections for Apple Revenue and Earnings

Looking ahead, analysts and investors are keenly observing Apple’s trajectory as it strives for increased revenue amidst growing competition. With Apple revenue for 2025 projected to continue its upward trend, there is a strong potential for hitting significant revenue milestones. The company’s investment into novel technologies alongside its expansive services model positions it well against competitors, which is crucial in the tech landscape that is always evolving.

The consistent growth in Apple’s installed base of active devices, which the company claims is at an all-time high, plays a pivotal role in ensuring ongoing sales momentum. Each device sold feeds into Apple’s services ecosystem, creating a synergistic effect that enhances recurring revenue streams. This interplay between device sales and services is a core component of Apple’s growth strategy and is likely to bolster its earnings in the forthcoming quarters.

Impact of iPhone Sales Growth on Apple Financial Results

The impact of iPhone sales growth on Apple’s financial results cannot be overstated. As the largest revenue generator for the company, the iPhone has contributed $46.8 billion this quarter alone, reflecting its critical role in Apple’s financial health. The sustained demand for iPhones, especially with the launch of new models, demonstrates Apple’s ability to innovate and entice consumers, which is vital for maintaining competitive advantage in the smartphone market.

Moreover, the significance of iPhone sales extends beyond direct revenue; it also serves as a gateway to Apple’s Services. The more iPhones in the market, the larger the active installed base becomes, allowing for greater penetration of services like Apple Music, iCloud, and the App Store. This cyclical relationship helps Apple sustain its earnings momentum and positions it favorably for future growth as consumers increasingly opt for integrated digital experiences.

Apple’s Strategy for Sustaining Growth Amidst Market Challenges

Apple’s strategic maneuvers to sustain growth amidst market challenges involve enhancing product offerings and integrating services. With continuous innovation in its hardware lineup, including the latest iterations of iPhones, Macs, and iPads, Apple maintains its relevance and attracts new users. Coupled with the expansion of its services portfolio, Apple effectively addresses the changing demands of consumers who seek more than just products—they crave experiences.

Furthermore, Apple aims to remain resilient amid potential downturns by bolstering its commitment to sustainability, which resonates well with environmentally conscious consumers. The company’s achievement in reducing carbon emissions is a testament to its responsible growth strategy, which not only boosts brand loyalty but also aligns with global shifting priorities towards sustainability. As market conditions fluctuate, Apple’s holistic approach to growth could provide the stability it needs to navigate hurdles successfully.

The Role of Services in Apple’s Long-Term Financial Vision

With services now accounting for 28% of Apple’s revenues, their role in the company’s long-term financial vision is expanding rapidly. This pivot towards an increasingly service-oriented business model allows Apple to tap into recurring revenue streams that provide more predictability amid the cyclical nature of hardware sales. As the digital ecosystem evolves, Apple’s focus on diversifying its offerings through services positions the company for durable growth.

Investment in services such as Apple TV+, Apple Music, and Apple Arcade not only drives revenue but also enhances customer retention by embedding users within the Apple ecosystem. This strategy ensures that consumers who purchase Apple devices are likely to remain engaged with additional services, potentially increasing lifetime value. As Apple continues to enhance its service capabilities, its aim to achieve financial resilience appears to be well within reach.

Evaluating Apple’s Competitive Advantage in the Technology Sector

Apple’s competitive advantage in the technology sector is propelled by its relentless innovation, strong brand loyalty, and a well-integrated ecosystem. The company’s ability to launch products that seamlessly connect and enhance user experience differentiates it from competitors. For instance, the introduction of the iPhone 16e not only reinvigorated sales but also underscored Apple’s commitment to delivering cutting-edge technology that aligns with consumer desires.

Moreover, brand loyalty plays a crucial role in consumer purchasing behavior; customers who own an Apple device are more likely to continue investing in Apple’s product line. This loyalty creates a secure revenue stream and positions Apple favorably in times of market volatility. The combination of a robust hardware lineup complemented by a solid service offering allows Apple to maintain a competitive edge in a swiftly changing technological landscape.

Sustainability and Its Impact on Apple’s Business Model

Apple’s commitment to sustainability is increasingly influencing its business model and financial outcomes. With a strong focus on reducing its carbon footprint—achieving a notable 60% reduction in emissions over the past decade—Apple aligns its operational practices with growing environmental concerns among consumers. This not only enhances corporate reputation but also attracts a demographic that prioritizes sustainability in purchasing decisions.

The long-term implications of this sustainable approach are profound. As consumers become more environmentally conscious, businesses demonstrating eco-friendly practices are more likely to earn customer loyalty and drive sales. By integrating sustainability into every facet of its operations, from manufacturing to supply chain management, Apple sets a precedent that could yield substantial dividends, both in fiscal terms and in terms of brand equity.

The Future of Apple: Market Trends and Growth Opportunities

Looking ahead, the future of Apple appears promising, bolstered by capturing emerging market trends and identifying new growth opportunities. With technology rapidly evolving, including advancements in artificial intelligence, augmented reality, and IoT, Apple is well-positioned to capitalize on these trends through innovative product development and enhancements in existing services. Potential growth areas lie in health technology, smart home devices, and further expansions in content services.

Moreover, as global markets recover and adapt post-pandemic, Apple has the chance to penetrate new geographical segments where smartphone and tech penetration remains low. By catering to diverse consumer needs across various demographics and focusing on affordability without compromising brand integrity, Apple can open new avenues for substantial revenue growth in upcoming years.

Frequently Asked Questions

What were the key highlights from Apple quarterly earnings report for March 29, 2025?

In the Apple quarterly earnings report for the quarter ending March 29, 2025, the company reported a net income of $25 billion on revenues of $95 billion, marking a 5% year-over-year increase. Notably, the iPhone generated $46.8 billion in revenue, accounting for nearly half of total revenues, while Services revenue grew by 11.6% to $27 billion.

How did iPhone sales growth impact Apple’s financial results in the latest earnings report?

In the latest earnings report, iPhone sales growth showed a modest increase of about 2% year-over-year, contributing $46.8 billion to Apple’s overall revenue. This solid performance helped sustain Apple’s financial results amid varying trends in other product categories.

What factors contributed to Apple’s revenue projection for 2025 according to the quarterly earnings report?

Apple’s revenue projection for 2025 is bolstered by strong performance in Services, which saw an 11.6% growth to $27 billion, alongside the introduction of new devices like the iPhone 16e, Macs, and iPads. The growth in the installed base of active devices across all categories also suggests strong future demand.

How does Apple Services growth compare to the company’s overall quarterly performance?

Apple Services growth significantly outpaced the company’s overall quarterly performance, with an 11.6% increase to $27 billion in revenues. This contrasts with the overall revenue increase of 5% for the quarter, highlighting the growing importance of Services in Apple’s business model.

What were the challenges noted in the Apple quarterly earnings report regarding product categories?

The Apple quarterly earnings report revealed that while the iPhone, Mac, and iPad segments experienced growth, the Wearables, Home, and Accessories category faced a 5% decline in revenues to $7.5 billion. This decline presents a challenge for Apple as it seeks to diversify its revenue streams.

How does Apple’s carbon emission reduction strategy relate to their quarterly earnings report?

In the quarterly earnings report, Apple emphasized its commitment to sustainability by announcing a 60% reduction in carbon emissions over the past decade. This aligns with growing consumer preferences for environmentally responsible companies and may positively impact brand reputation and sales.

What impact did the new Mac and iPad releases have on Apple’s quarterly revenue?

The release of new Macs and iPads contributed positively to Apple’s quarterly revenue, with the Mac generating $7.9 billion (up 6.7%) and the iPad demonstrating impressive growth at $6.4 billion (up 15%). These results suggest strong consumer demand for Apple’s latest innovations.

| Key Points |

|---|

| Net Income: $25 billion |

| Revenues: $95 billion (5% YOY increase) |

| iPhone revenue: $46.8 billion (2% YOY increase) |

| Mac revenue: $7.9 billion (6.7% YOY increase) |

| iPad revenue: $6.4 billion (15% YOY increase) |

| Wearables, Home, Accessories: $7.5 billion (5% decline) |

| Services revenue: $27 billion (11.6% YOY increase) |

| Reduction in carbon emissions: 60% over past decade |

| New record in the installed base of active devices |

Summary

The Apple quarterly earnings report showcases the company’s impressive financial performance with a net income of $25 billion and revenues of $95 billion, both reflecting a 5% year-over-year growth. The results highlight Apple’s ability to maintain its leadership in the technology market, especially with strong performances in services and significant contributions from its product lineup, including the newly released iPhone 16e. While there was a slight decline in certain segments, Apple’s commitment to sustainability and innovation continues to resonate well with consumers.