Apple antitrust issues have finally moved into the spotlight, drawing significant attention from regulators and consumers alike. The recent Epic v. Apple ruling exposed the problematic nature of what critics term the “Apple tax monopoly,” where the tech giant imposes steep fees on in-app purchases that developers cannot ignore. This scrutiny comes at a pivotal moment in the ongoing Big Tech antitrust debate, as many now recognize how such in-app purchase policies contribute to digital purchase inflation, ultimately impacting users’ wallets. With the U.S. government ramping up efforts to address these anti-competitive practices, Apple finds itself wrestling with the consequences of its aggressive business strategies. As app developers like Spotify and Proton adapt to this newfound freedom, consumers are set to benefit from reduced prices and a competitive marketplace.

The debate surrounding Apple’s market dominance is part of a broader conversation on antitrust challenges faced by major tech corporations. Terms like “monopolistic practices” and “exclusive control over digital sales” encapsulate the concerns raised by the recent verdict against Apple, highlighting the need for reform in corporate regulations. As scrutiny tightens on these influential players, the ramifications of their policies become increasingly evident to consumers, especially regarding in-app purchasing dynamics. The emergence of alternative payment options marks a pivotal shift away from Apple’s stringent policies, leading to greater consumer choice and price reduction. This evolution not only signals a potential end to inflated digital costs but also poses a critical question about the future of competition in the tech industry.

The Growing Need for Apple Antitrust Regulation

The surge in antitrust scrutiny surrounding Apple stems from the company’s aggressive in-app purchase policies, often referred to as the ‘Apple tax.’ This practice has raised red flags not only among app developers but also among consumers who are beginning to feel the financial strain of inflated digital prices. In light of the Epic v. Apple ruling, which highlighted the severity of Apple’s monopolistic control, an increasing number of voices are calling for regulatory bodies to act decisively. The ruling serves as a wake-up call, emphasizing that consumers should benefit from competitive pricing rather than enduring the high costs perpetuated by one company’s policies.

Furthermore, amidst the broader push for Big Tech antitrust actions, Apple stands at the forefront, subjected to intense scrutiny in both the U.S. and European markets. This escalating attention compels stakeholders to reevaluate not only how app store systems work but also to consider the implications of prolonged monopolistic practices. The need for structural change in how Apple conducts its in-app purchase model is evident, signaling that regulation may be necessary to ensure fair competition and consumer protection in a rapidly evolving digital marketplace.

The Impact of Epic v. Apple Ruling on Digital Purchases

The Epic v. Apple ruling has fundamentally altered the landscape of digital purchasing, allowing developers to communicate directly with customers and potentially bypass the high fees typically associated with Apple’s App Store. This shift is not just about financial savings for app developers but is also a significant step towards empowering consumers who will likely see immediate benefits in the form of lower prices. As companies like Proton and Spotify adjust their policies to reflect these changes, consumers are poised to experience a newfound freedom in how they choose to make purchases within their favorite applications.

Moreover, the ruling signifies a critical moment in advocating for a level playing field among digital platforms. By making it possible for developers to market their offerings outside of Apple’s ecosystem, this decision not only combats the inflated prices associated with the ‘Apple tax’ but also paves the way for innovation and diverse options for consumers. A thriving app economy depends on such changes as developers strive to make their offerings more appealing without the burden of excessive fees imposed by a monopolistic entity.

How the Apple Tax Affects Consumer Choice

The debate surrounding the so-called ‘Apple tax’ centers on the consumer’s right to choose and the extent to which Apple’s in-app purchase policies limit that right. By enforcing a 30 percent cut on purchases made through its platform, Apple not only profits but inherently restricts how developers can price their products and services. This practice raises significant concerns about the potential for digital purchase inflation, as developers may be forced to pass on the costs to consumers. As the market becomes more aware of this cycle, many users are starting to advocate for change.

Additionally, the implications of the Apple tax extend beyond just monetary costs; they also influence the variety of services available on the platform. Developers might alternatively opt out of Apple’s ecosystem, which could diminish the diversity of applications accessible to users. The ongoing discussions around these issues highlight the balancing act between ensuring fair compensation for developers and maintaining an environment that fosters accessibility and innovation in digital commerce.

The Role of Competition in Digital Marketplaces

The intensifying competition among digital service providers is pivotal in determining how companies like Apple adjust their practices. As we see companies such as Amazon and Spotify finding ways to circumvent Apple’s in-app purchase monopoly, the threat of decreased consumer engagement looms over Apple. This competitive pressure forces the tech giant to reconsider its stance on policies such as its 30 percent fees. It also increasingly demonstrates that a lack of responsiveness to market demands can lead to a loss of user base and revenue.

Additionally, competition in digital marketplaces fuels innovation, compelling companies to enhance their services and diversify their offerings to attract consumers. In a landscape where users are increasingly vocal about pricing and service quality, the need for firms like Apple to adapt to changing consumer expectations becomes glaringly apparent. Should Apple fail to adjust its policies in light of external competition, it risks becoming obsolete as users gravitate towards better offerings elsewhere.

Exploring Alternative Payment Solutions in the App Market

The recent shift in app market practices opens the door for alternative payment solutions that bypass Apple’s stringent in-app purchase regulations. With the pressure to lower costs, many developers are looking beyond traditional payment models, considering options that directly benefit both users and themselves. These alternatives not only allow app creators to regain control over their pricing structures but also significantly reduce digital purchase inflation that consumers have begun to notice.

This transition signifies a transformative moment in how digital transactions occur, potentially allowing for more competitive pricing and choices for users. As apps like Proton facilitate payments outside of the Apple ecosystem, it sets a precedent that may inspire a broader movement among developers. This change is likely to lead to an increase in consumer savings, ensuring that users are not penalized by inflated costs simply due to platform restrictions.

The Impact of Antitrust Movements on Big Tech

The growing scrutiny of Big Tech, especially in light of antitrust movements, indicates a pivotal shift in how these companies operate. Regulators are increasingly aware of the singular control held by powerhouses like Apple over their respective industries. The actions taken against Big Tech reflect a broader concern about monopolistic practices that inhibit competition and disadvantage consumers. As the U.S. government ramps up its examination of companies such as Apple, the antitrust conversation becomes more relevant than ever.

Moreover, the implications of these antitrust movements extend beyond Apple to encompass a wider array of Big Tech players. These shifts are pivotal not only for the immediate future of these corporations but also for the procedural tones set for future regulations that may encourage more competition in technology sectors. With the potential for legislation aimed at curbing monopolistic behaviors, we may see a more equitable landscape that prioritizes consumer interests and innovative solutions.

Tech Giants and the Fight Against Market Monopoly

The ongoing battle against market monopolies highlights the determination of various tech giants to reshape the competitive landscape. Companies are realizing that collaboration and community advocacy can prompt substantial changes in how platforms like Apple operate. The mobilization of groups arguing for fair treatment can lead to tangible adjustments in perceived monopolistic practices, ultimately benefitting consumers. This collective effort to challenge the status quo is vital in dismantling monopolistic strongholds within the tech industry.

As more developers join the fight against Apple’s in-app purchase policies, their collective voice can create substantial changes in the marketplace. By advocating for policies that promote fair competition and transparency, these companies can not only enhance their own business opportunities but can also foster an environment where consumer choice is prioritized. This movement could lead to disruptions in existing paradigms, ultimately creating a healthier marketplace for both users and developers alike.

Future Implications of Antitrust Actions on App Development

As the antitrust actions against companies like Apple evolve, the implications for app development are profound. Developers are finding new pathways to engage with their customers directly, leveraging the changes initiated by court rulings to prioritize user experience over restrictive in-app purchase policies. This shift could lead to an entirely new era of app development, where creative freedom and consumer-centered offerings flourish without the burden of excessive fees.

Additionally, the ongoing transformations in the app marketplace hint at a future where innovation is significantly encouraged. As competition intensifies, it’s likely that developers will work harder to differentiate themselves and create cutting-edge solutions that resonate with consumers. Ultimately, these changes not only enhance the richness of the app ecosystem but also empower users to make more informed purchasing decisions, free from the constraints of monopolistic practices.

The Connection Between Antitrust Actions and Digital Economy

The intersection of antitrust actions and the digital economy speaks volumes about the need for transparency and fairness in the marketplace. By addressing monopolistic practices, countries aim to foster a digital economy that encourages competition and innovation. As consumers become more aware of the implications of decisions made by tech giants, their advocacy can shape a more equitable landscape where digital services thrive without undue influence from a single company.

This connection underscores the importance of a regulatory framework that adapts to the fast-paced changes within the tech sector. Antitrust actions are not merely punitive but serve as vital tools for crafting a digital economy that prioritizes consumer welfare and equitable practices. As stakeholders engage in ongoing discussions, the future of the digital marketplace will hopefully reflect values of competition, transparency, and user empowerment.

Frequently Asked Questions

What is the significance of the Epic v. Apple ruling in terms of Apple antitrust issues?

The Epic v. Apple ruling is significant as it marks a critical moment in the ongoing Apple antitrust scrutiny. The court found Apple had maintained an unlawful monopoly over in-app purchases, commonly referred to as the ‘Apple tax’, compelling it to allow developers to inform customers about external purchasing options, thus challenging its anti-competitive practices.

How does the Apple tax monopoly affect app developers and consumers?

The Apple tax monopoly imposes a 30% fee on all in-app purchases, leading to inflated prices for consumers and reduced profits for developers. This practice has been scrutinized under antitrust laws as it limits competition and stifles innovation within the app ecosystem.

What are Apple’s in-app purchase policies, and how do they relate to antitrust concerns?

Apple’s in-app purchase policies mandate that all digital goods sold within iOS apps use Apple’s payment system, subject to its 30% commission. These policies have raised antitrust concerns as they create an unfair marketplace for developers and restrict consumers’ purchasing choices.

How might the recent antitrust actions against Big Tech, specifically Apple, influence digital purchase inflation?

The recent antitrust actions could reduce digital purchase inflation by allowing developers to bypass Apple’s payment system, potentially decreasing prices by up to 30%. This shift could lead to more competitive pricing in the digital marketplace, benefitting consumers.

Can you explain the implications of Apple’s anti-competitive behavior on competition in the tech industry?

Apple’s anti-competitive behavior, particularly its control over in-app purchases and the ‘Apple tax’, limits competition by creating barriers for alternative payment options. This conduct has been under scrutiny, as it undermines fair competition and inhibits innovation among app developers, leading to a need for regulatory oversight.

How does the Apple antitrust case compare to other tech giants facing scrutiny?

The Apple antitrust case mirrors other Big Tech antitrust battles, such as those involving Google and Facebook, where concerns over monopolistic practices and market dominance have prompted regulatory investigations. Each case reflects the broader challenge of managing competition in an increasingly digital economy.

What changes have app developers made following the Epic v. Apple ruling?

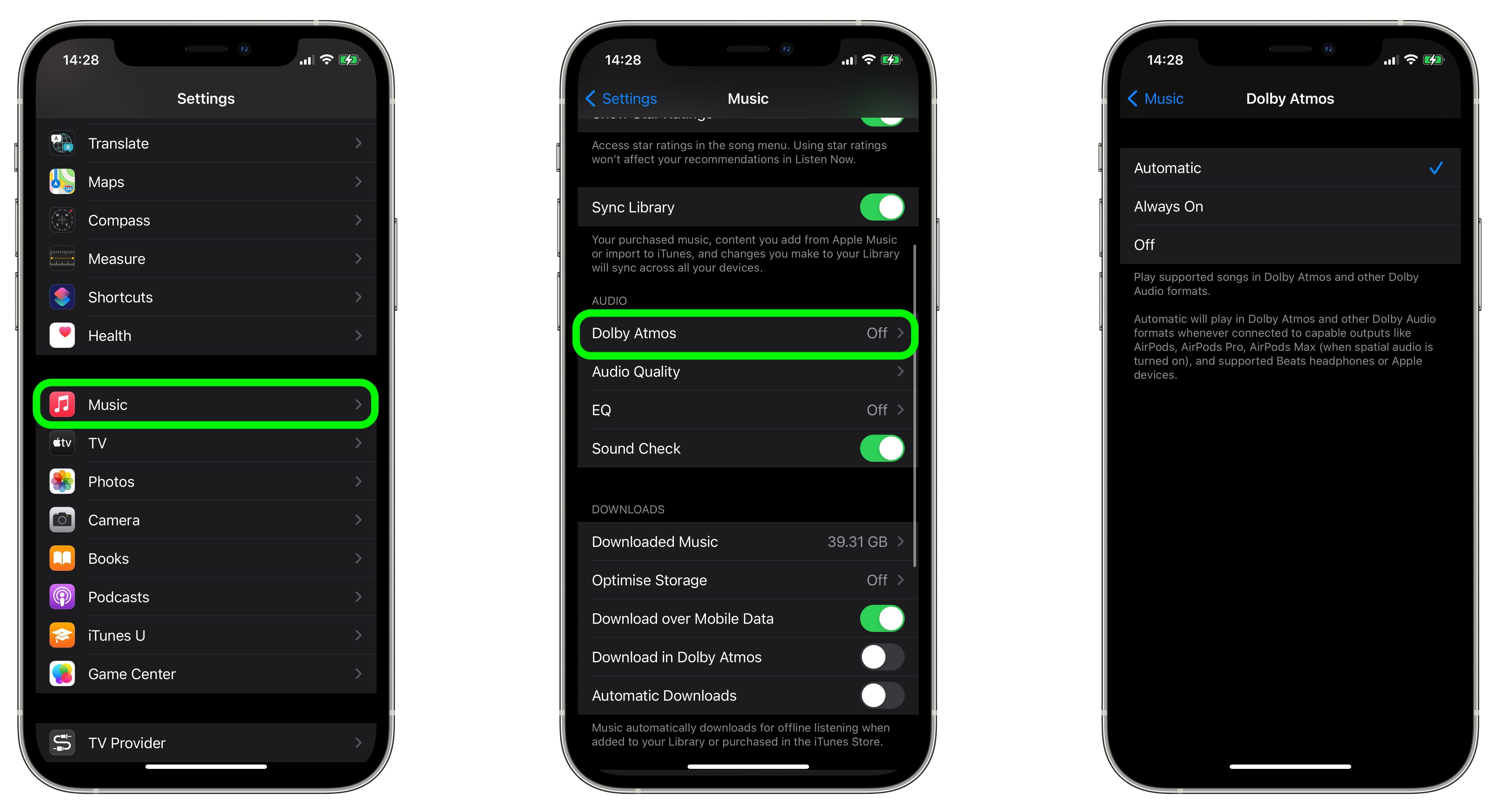

Following the Epic v. Apple ruling, many app developers, including Spotify and Proton, have updated their apps to allow for external payments, effectively bypassing Apple’s in-app purchase mandates. This change signifies a shift towards more competitive practices and has the potential to lower prices for consumers.

What role does government regulation play in addressing Apple antitrust issues?

Government regulation plays a crucial role in addressing Apple antitrust issues by enforcing competition laws and promoting fair practices in the tech industry. Increased scrutiny and potential legislation aim to dismantle monopolistic behaviors that harm consumers and stifle innovation.

What can consumers do to voice their concerns about Apple’s antitrust practices?

Consumers can voice their concerns by supporting regulatory efforts, participating in petitions, and advocating for more competitive policies within the tech industry. Being informed about pricing and the implications of the ‘Apple tax’ can also influence purchasing decisions and demand fair practices.

What does the future hold for Apple and competition in the digital marketplace?

The future for Apple and competition in the digital marketplace hinges on ongoing antitrust scrutiny and potential regulatory changes. With growing pressure from developers and consumers, we may see a shift towards more open ecosystems that foster competition, lower prices, and enhanced consumer choice.

| Key Point | Details |

|---|---|

| Antitrust Action Overview | Increased scrutiny of tech giants, particularly Apple, due to anti-competitive practices. |

| Epic v. Apple Case | A court ruling forced Apple to allow app developers to communicate with customers outside the app, breaking its 30% fee monopoly. |

| Impact on Payment Systems | Companies like Spotify and Proton are now allowing payments outside of iOS apps, thus avoiding Apple’s fees. |

| Reduction in Prices | With the removal of the ‘Apple tax’, companies can reduce prices for consumers by up to 30%. |

| Restoration of Features | Amazon has restored e-book purchases in its Kindle app, allowing purchases directly from its website without iOS markup. |

| Legal and Market Ramifications | The ruling demonstrates anti-competitive behavior by Apple and raises questions about similar practices like those against Microsoft. |

Summary

The Apple antitrust situation signifies a pivotal moment in tech regulation, illustrating how legal actions can challenge monopolistic practices. With increased scrutiny from both the EU and the U.S. government, consumers are witnessing significant changes in how major tech companies operate. The Epic v. Apple case has opened doors for app developers, allowing them to communicate better with customers and offer alternative payment options, ultimately benefiting consumers by reducing prices. This shift not only sheds light on Apple’s previous anti-competitive behaviors but also sets a precedent for how other companies may navigate similar legal landscapes, potentially reshaping the digital economy.